Buying Property? Escrow – What Is It?

Last week I wrote a Blog on the Escrow process and how it works. I talked to a couple of people who read that blog and they told me they did not understand what I was saying on the blog. This really made me feel good (sarcasm). After reflecting on the comments, I had to agree, I could have done a better job of explaining the Escrow process. I can remember back to being a first-time home buyer and how nervous I was when buying my first home. Everything was new. Luckily, I had a good Realtor and she helped guide my wife and me through the process.

Last week I wrote a Blog on the Escrow process and how it works. I talked to a couple of people who read that blog and they told me they did not understand what I was saying on the blog. This really made me feel good (sarcasm). After reflecting on the comments, I had to agree, I could have done a better job of explaining the Escrow process. I can remember back to being a first-time home buyer and how nervous I was when buying my first home. Everything was new. Luckily, I had a good Realtor and she helped guide my wife and me through the process.

If you are a new home buyer you will hear terminology that you may not have heard before. Key terms that you need to know to understand the Escrow process include the following:

Title Company – this is a 3rd party company that is hired to search the public records to make sure there are no defects or encumbrances against the title of the property.

Title Insurance – this is insurance that the buyer (or seller) of the property can purchase from the title company which insures against financial loss from defects in “title” to the property and from the invalidity or unenforceability of mortgage loans

Escrow Company – Is a neutral company that serves as a 3rd party to ensure that all conditions of a real estate transaction are met. The key words in this definition are “neutral” and “3rd party”. Also, note that the Title Company and the Escrow company do not need to be the same company. However, the Title company typically provides the escrow service as well.

Escrow Agent – employee of the Escrow company who will facilitate the escrow process and will ensure that the conditions of the real estate transaction are met. They will make sure the conditions specified in the contracts are followed and that no funds or documents are dispersed until the conditions have been met. They will also provide settlement statement and insure the required documents are recorded in the proper location. Sometimes a property may “fail to close”. This means that the conditions of the contract have not been met by at least one of the parties involved and therefore the sale of the property does not happen.

House under contract – this is the signing of the contract that specifies the conditions of the sale of the house by the seller and the buyer.

Open Escrow – This is the start of the escrow process. Either the buyer or the seller can open escrow. Typically, they will mutually agree on the Escrow company for the escrow company is a neutral 3rd party company. Escrow is opened after the contracts for the sale of the property have been signed.

Close escrow – This is when all the conditions of the contract have been met, all funds and documents have been dispersed.

Closing – the final meeting to sign the documents and disperse funds.

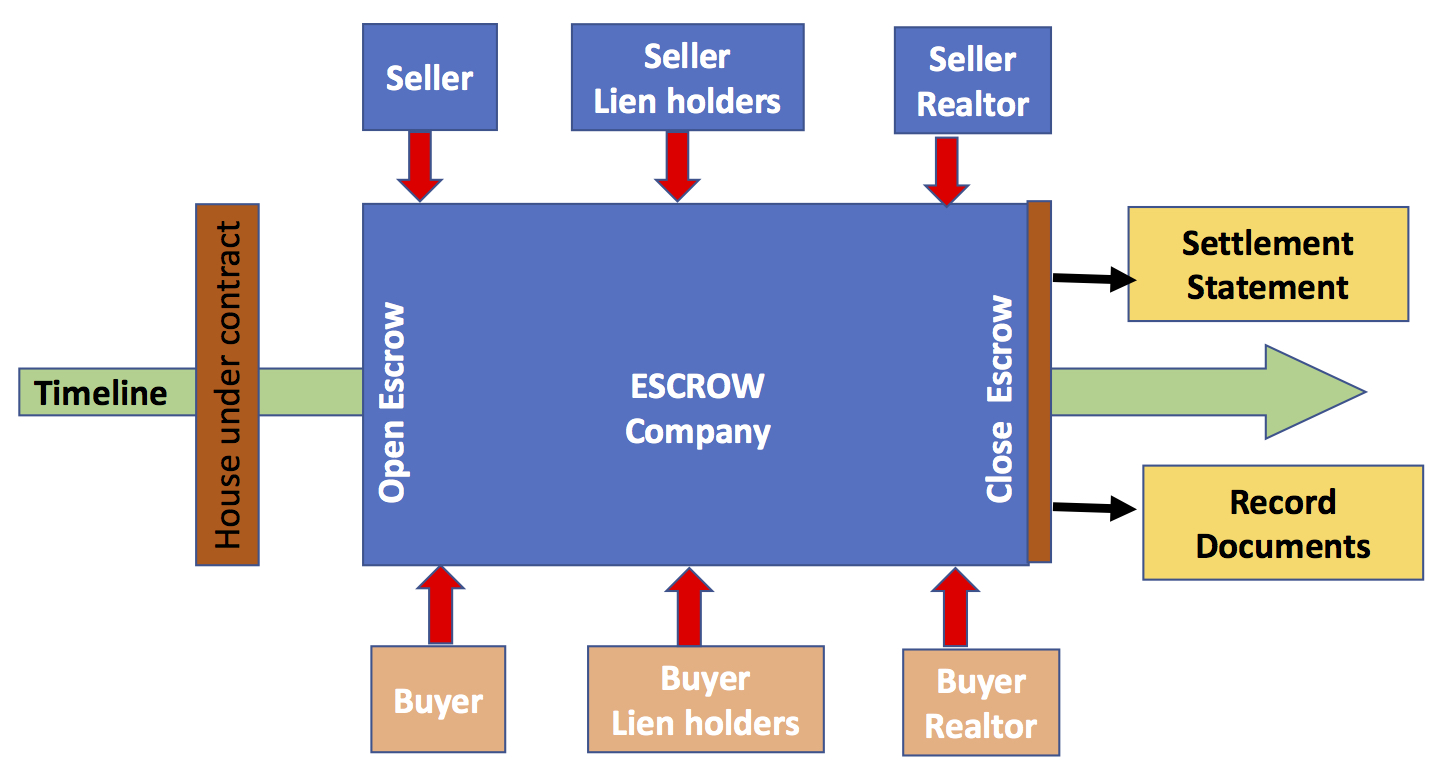

A common question that gets asked is “Who are the key players in the escrow process and what do they do?” The answer to this is simple if you think of it in terms of who “gives” and “gets” in a real estate transaction. The seller ultimately gets money and the buyer ultimately gets the property. This is the whole point of bringing a buyer and seller together.

There are other people involved as well, there are the Realtors for the buyer and seller. The buyer and seller each may have a lender. The buyer’s lender providing money to buy the property and the seller’s lender receiving what is owed to them when the property sells.

Here is a list of the key people/principles and what each one is expected to “give” and what they expect to “get” during the Escrow Process. The figure included in this blog show the key players involved as well.

Seller

- Gives – escrow instructions and some form of ownership

- Gets – liens paid off and some form of money

Seller Lien holder (Typically the mortgage holder)

- Gives – Reconveyance/Release of Lien

- Gets – Money

Seller Realtor

- Gives – Guidance on the process.

- Gets – commission (money) for marketing the house and helping to find a buyer

Buyer

- Gives – money, Promissory note, and Mortgage (Deed of Trust)

- Gets – form of ownership

Buyer Lien holder (Typically Lenders)

- Gives – money,

- Gets – Mortgage (Deed of Trust) and Promissory note

Buyer Realtor

- Gives – guidance on the process

- Gets – commission (money) for finding the house and guiding the buyer through the process.

Escrow Company

- Gives – Protection of Title Interests and Contractual interest (facilitates the process)

- Gets – Money for services (split between buyer and seller)

Title Company

- Gives – Researches the title and sells insurance to guarantee title

- Gets – money for services and title insurance sold. Typically sell two policies, one for the buyer and one for the lender.

Each of the above people/principles submits documents and /or money to the Escrow Agent within the Escrow timeframe. They do not need to worry about the order of submittal. The duty of the Escrow Agent is to make sure all documents are received and all money is received and that the conditions specified in the contract are followed. The Escrow agent is also responsible to disperse funds and documents in the proper order. The Proper closing order is to release old liens, transfer ownership, record new liens.

I have to put the “I am not an attorney” note in this blog. I tried to make things easier to understand but you should consult you Real Estate Attorney for any legal advice that you need.